Bespoke lending solution for underserved or special purposes

Not every lending need fits a standard, off-the-shelf product. Our platform lets organisations create tailored lending products quickly and securely, with the flexibility to design schemes that work for their audience.

Empowering meaningful lending products that drive real impact

Governments, NGOs, startups, and financial institutions often require bespoke digital lending schemes to serve specific communities, causes, or markets. Existing platforms cannot accommodate these specialised needs. We built our digital lending solution to fill that gap.

We’re empowering institutions and startups to launch meaningful financial products that can reach underserved markets and drive real impact across Africa.

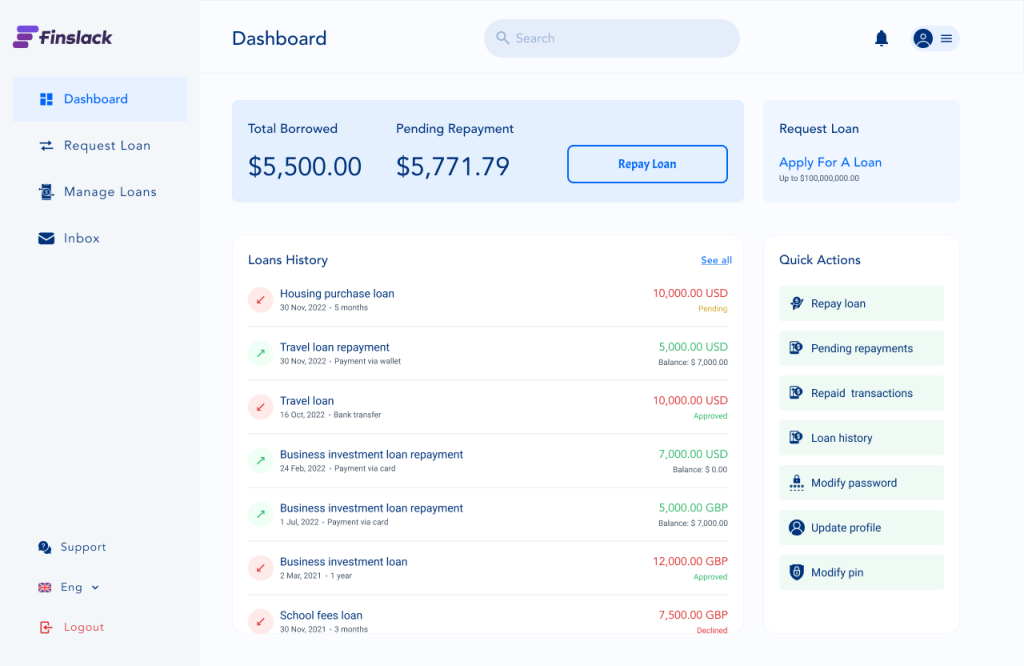

Create and manage loan products

Effectively manage your lending with smart digital tools geared towards securing your business and improving clients’ lending experience.

- Credit decision engine

- KYC and onboarding

- In-life collections management

- CRM integration

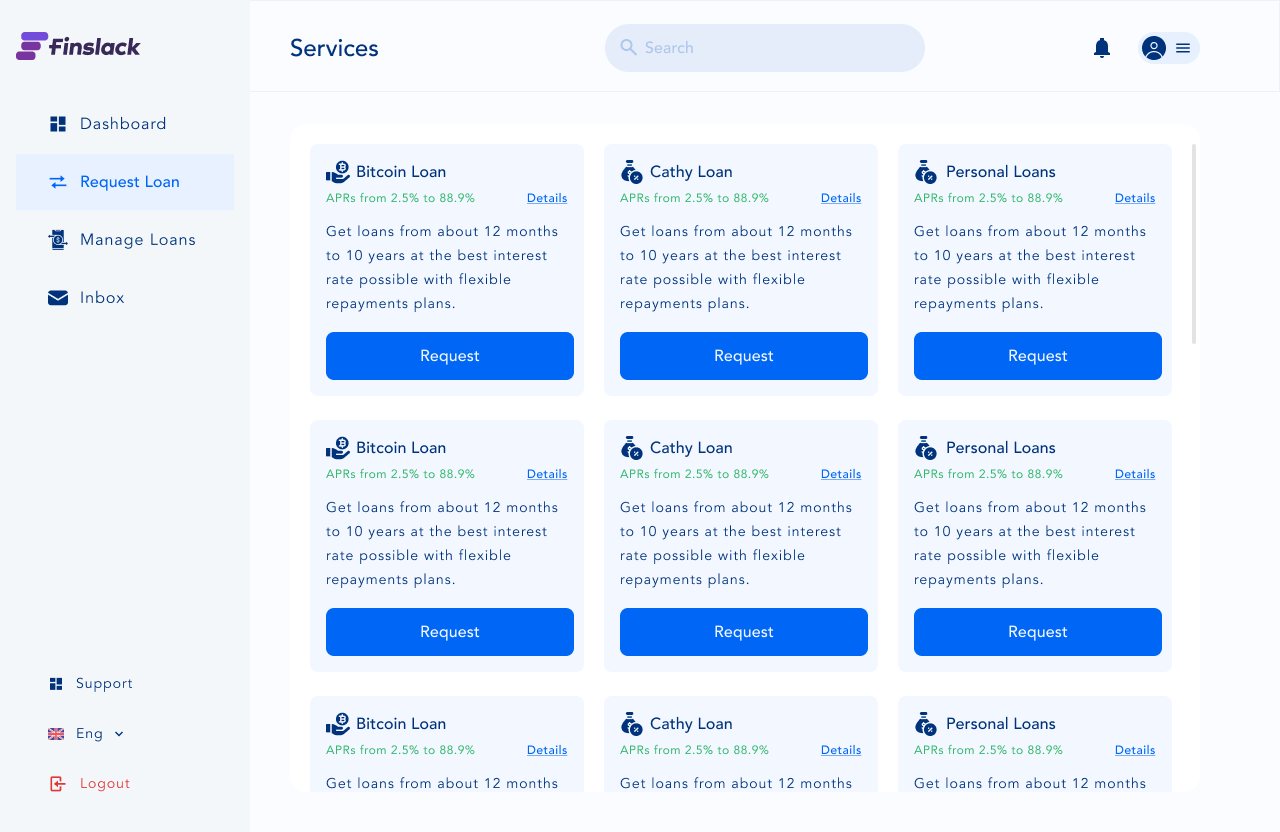

Distribute loan products via custom channels

Extensive plug and play integrations. Customers access your loan product through a custom web portal or SDK loan mobile application.

- Create your app customer interfacing using our UI components or API

- Seamless eligibility verification and onboarding

- iOS and Android

- Embedded finance

Features that ensures a successful loan business

Originate loans

Automate and manage your loan application and disbursal process. An automated verification system underwrites loan applications, makes credit decisions, and performs quality checks using clients’ data.

- Automate data collation

- Digital verification of client’s information

- Integrate third-party solutions into your loan system

Debt factoring

Manage the purchase, collection, or resell of debts collected. Buy delinquent or charged-off debt at a fraction of the debt's face value, track and manage debt collection or resell all or portions of the debt.

- Full access to debtors’ data

- Automated debt collection system

- Track communication between your employees and debtors

- Flexibility to retain or resell debt collected

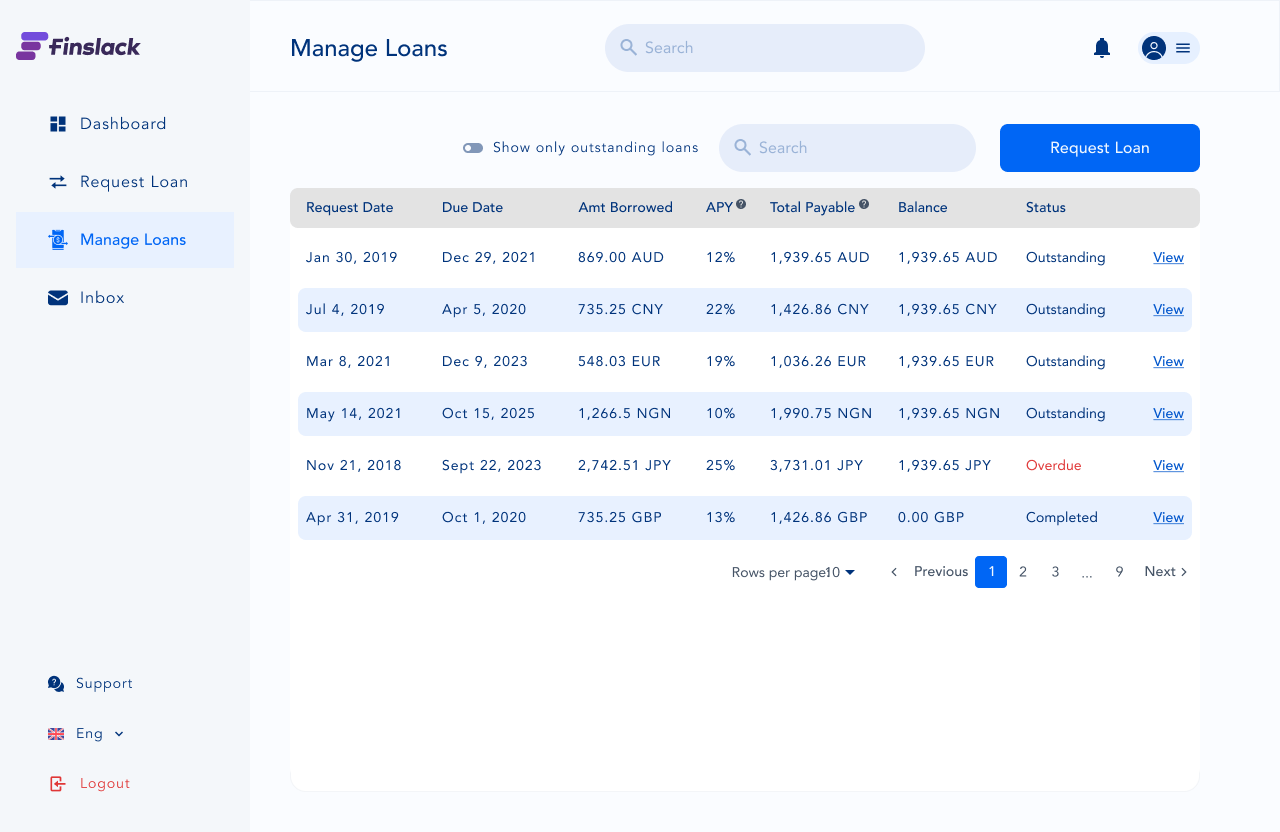

Loan repayment schedule

Let your clients and employees track and manage periods of loan repayment. Loan information is broken down into principal, interest, and other elements in the amortization schedule.

- Notify clients ahead of loan repayments

- Schedule interest rates for early and late payments

- Comprehensive loan information analytics

Service loans

Automate all loan activities after disbursement to the borrower. Automated activities include updating clients' information, calculating interest rates and fees, notifying borrowers of payments due, and collecting payments

- Automated debt collection system

- Reduce servicing costs

- Track payments, account statements, and collaterals

- Notify borrowers of payment due dates

Loan accounting

Monitor disbursed loans, repayments and cashflows. Get analytical insights into business and marketing data like clients’ profiles, conversion rate, company turnover, and more

- Loans and repayments status

- Transaction and comprehensive turnover reports

- Get a picture of your loan business performance at a glance

- Financial statements for audits and tax authorities

Key features that make it all possible

Fully Compliant

We own compliance and have done the heavy lifting of reducing the risk of financial fraud so you can run your business smoothly.

Maximum Security

Prevent unauthorized access to tools using cutting-edge security technologies. Distribute access rights to your staff with varying authorizations.

Customizable

Our suite of flexible components and APIs lets you build out bespoke functionalities, integrate third-party services and brand your product.

Reliable

Finslack robust and multi-tenant architecture allows multiple clients' systems to run concurrently on a central server with 99% system uptime.

See what else you could launch

Payment Switch

Facilitate cross-border payments for customers or just your business with ease.

Wallet / Electronic Money

Deploy an electronic money solution to let customers can store money or make payments.

Launch a fully-compliant and market-ready remittance business within weeks.

Wealth Manager

Offer tailored or diverse investment products for individuals and businesses.