Powering Africa’s

next fintech unicorns

We partner with credible African startups and fintechs to launch compliance-ready digital financial products in record time — aligning through equity or shared-revenue partnerships, because we believe the best companies are built together. We’re not a vendor. We’re in it with you.

![]() Go from ‘idea’ to → your market-ready fintech product in no time

Go from ‘idea’ to → your market-ready fintech product in no time

White label

our solutions

Struggling with product-build complexities? Go to market faster by customizing any of our ready-made solutions that fits your vision and launch your fintech product within weeks!

Embed our

APIs

Need payments, digital wallet, lending or investment capability in your product? Integrate a single API from our suite to start offering your desired fintech service to customers.

ecosystem

Leverage our extensive partner network (banks, payout networks, compliance, authentication providers and more) or onboard your own partners to launch your products.

We’ve overcome every challenge so you can succeed

With 10+ years experience encountering nearly all complexities founders face when launching fintech products in Africa, every solution FinCode offers is market-tested, proven and geared towards your guaranteed success.

Cost-effective

Save on the capital cost of building and maintaining your financial product’s infrastructure. Start lean leveraging our white-label solutions.

Faster time to market

FinCode’s ready-made platforms significantly reduce the go-to-market time for financial products. Launch in weeks, not years.

Security & compliance covered

Deliver financial products that are totally secured and fully compliant with country-specific legal requirements.

Full customization and integration

Add unique features and capabilities to your product to deliver financial services your customers love.

Simplifying the time and cost taken to launch fintech products in Africa

FinCode removes the technical barrier to launching digital financial products by providing an end-to-end suite of technologies to launch and scale fintech products. We understudy the tech challenges founders face when launching digital finance products in Africa and innovate solutions to solve them

Tailored solutions for businesses building the future of financial services in Africa

Payment Switch

Facilitate cross-border payments for customers or just your business with ease. FinCode‘s cross-border payment switch connects you directly to thousands of global payment partners to move money in 100+ countries —via a single integration.

Learn More

Learn More

Remittance

Launch a remittance business within weeks. Our full-scale remittance-as-a-service solution offers you everything you need to start and scale a remittance business, from cross-border payment technology, to compliance coverage, and day-to-day operational support.

Learn More

Learn More

Wallet / Electronic Money

Add a digital wallet solution to your product to allow customers to store money, crypto, top-ups, and other rewards. Manage users' wallet accounts and balances from a single touchpoint.

Learn More

Learn More

Lending

Launch and scale bespoke lending services tied to a good cause. Automate lending decisions, disbursements, debt collection and seamlessly manage your entire lending operations with Fincode's loan management system.

Learn More

Learn More

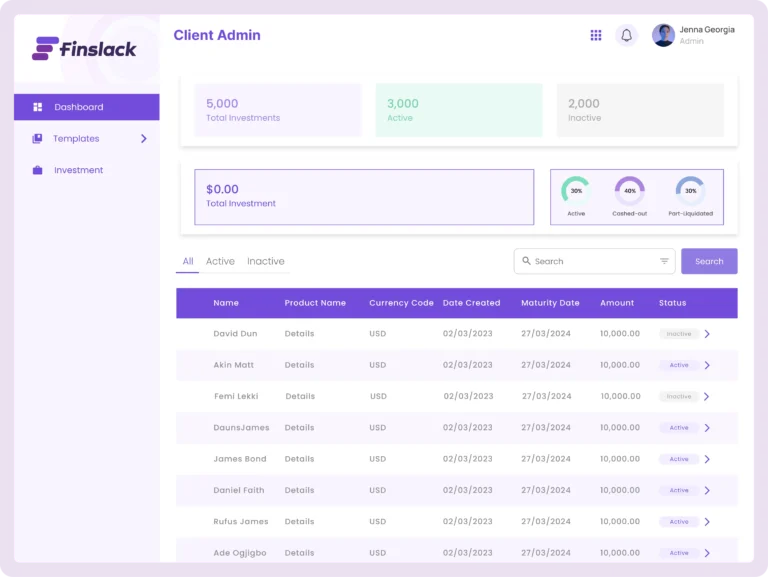

Savings & Investment

Offer customers tailored savings and diverse investment products for individuals and businesses. Streamline the process of buying, selling and monitoring a variety of assets for your clients.

Learn More

Learn More

Go live in 5 Simple Steps

Align on Your Business

We start by understanding your business needs, then walk you through a focused demo to confirm fit and next steps.

See the Platform in Action

You get a clear walkthrough of key features, workflows, and dashboards so you know exactly how the platform supports your operations.

Test in Sandbox

You receive sandbox access, API documentation, and a testing checklist to safely integrate and validate your rails and payment flows.

Integrate with Expert Support

Our specialists guide your tech team through API integration, monitor progress, and help resolve issues until test transactions succeed.

Launch with Confidence

We verify readiness, move you live, and closely monitor your first transactions to ensure a smooth and stable launch.